Get the free boe 64 ses

Show details

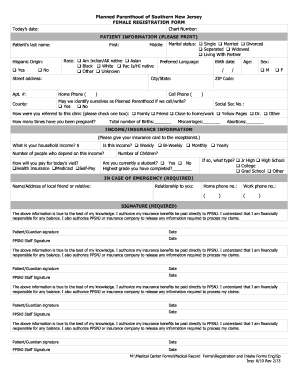

BOE-64-SES P1 REV. 01 11-08 INITIAL PURCHASER CLAIM FOR SOLAR ENERGY SYSTEM NEW CONSTRUCTION EXCLUSION California law provides that under certain circumstances the initial purchaser of a building with an active solar energy system may qualify for a reduction in the assessed value of the property. In order to qualify for this reduction this claim form must be completed and signed by the buyer and filed with the Assessor.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign boe form

Edit your boe forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your boe example form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit boe document online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit boe 64 ses form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out boe 100 b form

How to fill out boe 64 ses:

01

Begin by obtaining a copy of the BOE 64 SES form.

02

Fill out the general information section, including your name, contact information, and any applicable account numbers.

03

Provide the required information for each section of the form, such as your business activity details, sale information, and any applicable deductions or exemptions.

04

Make sure to accurately calculate the total sales, taxable sales, and the corresponding tax amounts.

05

Sign and date the form, certifying that the information provided is true and accurate.

06

Submit the completed BOE 64 SES form to the appropriate tax agency or department by the designated deadline.

Who needs boe 64 ses:

01

Individuals or businesses engaged in selling tangible personal property or taxable services in the state where the BOE 64 SES form is required.

02

Taxpayers who meet the predefined sales thresholds or meet the specific criteria established by the tax agency.

03

This form is typically required for sales and use tax reporting purposes and is necessary to comply with state tax laws and regulations.

Fill

sale of home form

: Try Risk Free

People Also Ask about formulario ses

Is there a tax break for solar in California?

How does the California solar tax credit work? California no longer has a state solar tax credit. However, the federal solar tax credit is worth 30% of the installed cost of a solar and/or battery system. This credit can be used to decrease your federal tax liability and increase your tax refund.

Does California have a solar property tax exemption?

Section 73 of the California Revenue and Taxation Code allows a property tax exclusion for certain types of solar energy systems installed between January 1, 1999, and December 31, 2024.

Will installing solar panels increase my property taxes in California?

Section 73 of the state's revenue and taxation code allows a property tax exclusion for qualifying new solar installations. Meaning, your property taxes will not increase if you solar on your property.

Are solar panels taxable in California?

Solar Energy System Property Tax Exclusion The California State Board of Equalization has approved the Active Solar Energy System Exclusion. So if you a new home solar system in California or build a house with a solar panel system, your property taxes won't increase until the end of the 2024 fiscal year.

Will my homeowners insurance go up if I solar panels?

You may not see an increase in your homeowners insurance premium after installing solar panels on your roof. However, you'll likely need to raise your coverage limits to account for the replacement cost of your solar panels, which will likely result in some increase to your premium.

How much does solar increase property value in California?

Solar Panels FAQ Yes, solar panels will raise your home's property value. Although the added value can vary by location, the National Renewable Energy Laboratory (NREL) found that home value increases by $20 for every $1 saved on your utility bills. This translates to a higher market value when selling your home.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send original sworn declaration of gross sales to be eSigned by others?

When you're ready to share your form 5398, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for the boe application in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your boe documents in minutes.

How do I fill out boe sample on an Android device?

On an Android device, use the pdfFiller mobile app to finish your boe 64 ses form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is boe 64 ses?

BOE 64 SES refers to a tax form used for reporting specific state sales and use tax information in California.

Who is required to file boe 64 ses?

Businesses operating in California that are registered for sales and use tax purposes must file BOE 64 SES if they meet certain thresholds.

How to fill out boe 64 ses?

To fill out BOE 64 SES, businesses need to follow the guidelines provided by the California Department of Tax and Fee Administration, accurately reporting sales figures and tax collected.

What is the purpose of boe 64 ses?

The purpose of BOE 64 SES is to report sales and use tax collected by retailers to ensure compliance with state tax laws.

What information must be reported on boe 64 ses?

The form requires reporting on total sales, taxable sales, exempt sales, and the amount of tax collected during the reporting period.

Fill out your boe 64 ses form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Boe 64 Ses Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.